Solutions > Advertising Measurement

InnovidXP: Reimagine converged

TV measurement

The premiere, media-unbiased platform for linear, CTV, and digital video measurement and attribution.

Converged TV

Ad Measurement & Outcomes

Built for brands, designed with agencies, and approved by the top publishers, InnovidXP goes beyond traditional TV measurement: We don’t just validate results. We deliver them. Our pioneering ability to optimize outcomes in real-time is made possible by Innovid’s unique market position as an ad server, attribution partner, and the bridge between. Unifying ad measurement with ad management, we work to save you money through optimization, simplify your life with automation, and innovate your marketing strategy.

More Than Insights,

InnovidXP Drives Results.

TV measurement is experiencing a revolution, driven by emerging platforms, diversified datasets, and an industry-wide quest for universal metrics. InnovidXP leads it. We empower advertisers to measure linear and digital TV advertising alongside one another — analyzing total reach and outcomes at scale via a unique, unbiased solution. Built to scale locally, nationally, and even globally, InnovidXP can take you beyond static measurement to transform learnings into media and messaging strategy, automate insights into action, and instantly optimize campaign outcomes, all within a single destination.

The InnovidXP Difference:

- Unlock our pixel-less, turn-key solutions in a day, already certified by thousands of top publishers.

- Trustworthy cross-publisher results as measured by a media-unbiased partner, who doesn’t need to prioritize owned, operated, or arbitraged inventory.

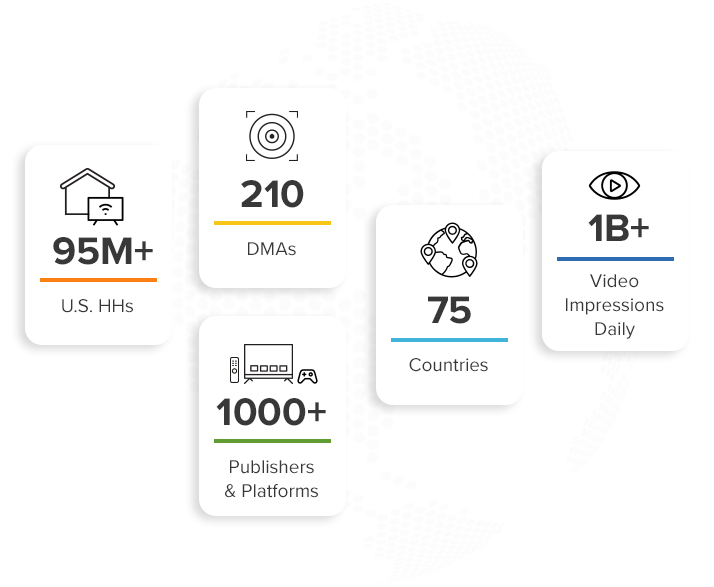

- Leverage our unmatched, straight-from-the-source view into streaming data of over 1 billion MRC-accredited video impressions served daily.

- Actionable insights to drive media strategy chiefly through granular inter-publisher comparisons of reach, frequency, unique reach, and outcomes.

- Enable Instant Optimization with a single button click, to allow creative delivery decisioning to be informed by InnovidXP measured outcomes, ensuring the best-performing ads find the right audience.

Measurement and Outcomes

In A Single Destination

Built by an expert team of data scientists and engineers, the real-time and always-on InnovidXP eXPerience delivers reach, frequency, incremental reach, and attributed outcomes across linear, CTV and digital video buys, no matter your campaign size, goals, or geography. Access your results with easy-to-use tools, flexible data visualizations, and anytime export functionality.

With InnovidXP, you can:

- Measure the unique reach and overlap of linear vs. streaming video.

- Measure the unique reach and overlap across and between individual media suppliers.

- Evaluate which specific publishers, networks, and media partners drive the most – or least – impact to campaign outcomes.

- Understand not only which media partners are top performers, but also the most cost-effective way to buy their inventory (supply path optimization).

- See the immediate impact of your creative messaging by week, day, and even daypart.

- Understand your universal cross-publisher ad frequency, enabling you to set more accurate frequency caps at the individual providers, platforms, or device level.

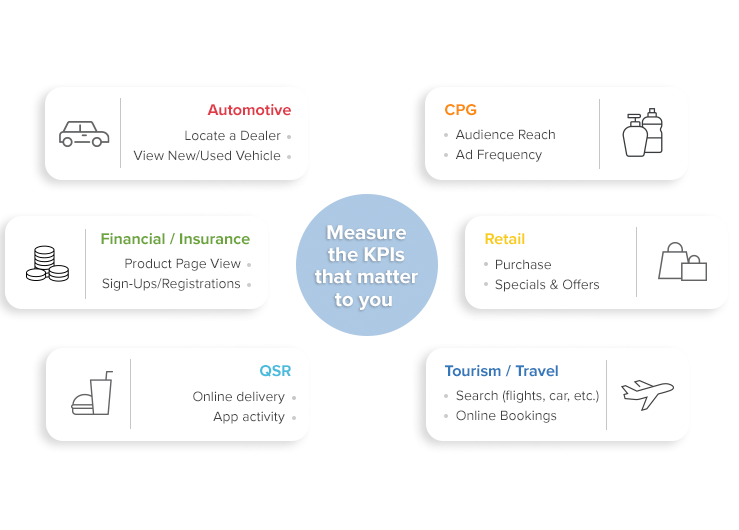

- Measure any KPI from web visits to online sales, sign-ups, and app activity.

TV Metrics that Matter

With a unified view of linear TV and digital TV advertising, InnovidXP enables advertisers across global markets and industries to measure the KPIs that matter most. Our always-on platform delivers transparency into converged TV metrics to prove ROI and demonstrate business impact across key actions like sales, registrations, app activities, web visits, audience reach, offline data, and more. With InnovidXP, you can see real-time results, and apply them to campaigns mid-flight.

Superior Data Is at the Core

of Converged TV Ad Measurement

InnovidXP leverages an arsenal of viewership and ad occurrence datasets spanning ACR-data, smart TVs, and set-top-boxes to connect the dots across the landscape of linear, CTV, and digital video. Our uncontested status as an objective, media-unbiased company elevates measurement conversations above theoretical rating points and subjective currency. We focus on data-driven, data-authenticated reporting that validates at a local level to ensure nationally accurate results rather than aggregation.

Comprehensive, Future-Built

Identity Infrastructure

Our best-in-class measurement methodology is powered by Innovid Key: an advanced, next-generation identity infrastructure with an unmatched, straight-from-the-source view across a footprint of 95 million US households. Validated by over one billion MRC-accredited video impressions served daily. We map these privacy-compliant data signals across partners to connect first-and third-party audiences in a secure manner. The result is identity resolution at scale, allowing advertisers to measure the impact of their messaging across linear, CTV and digital video platforms while ensuring data transparency and ownership.

What Else Can We Help You With?

Want to Learn How We Can Make Your Advertising Easier?